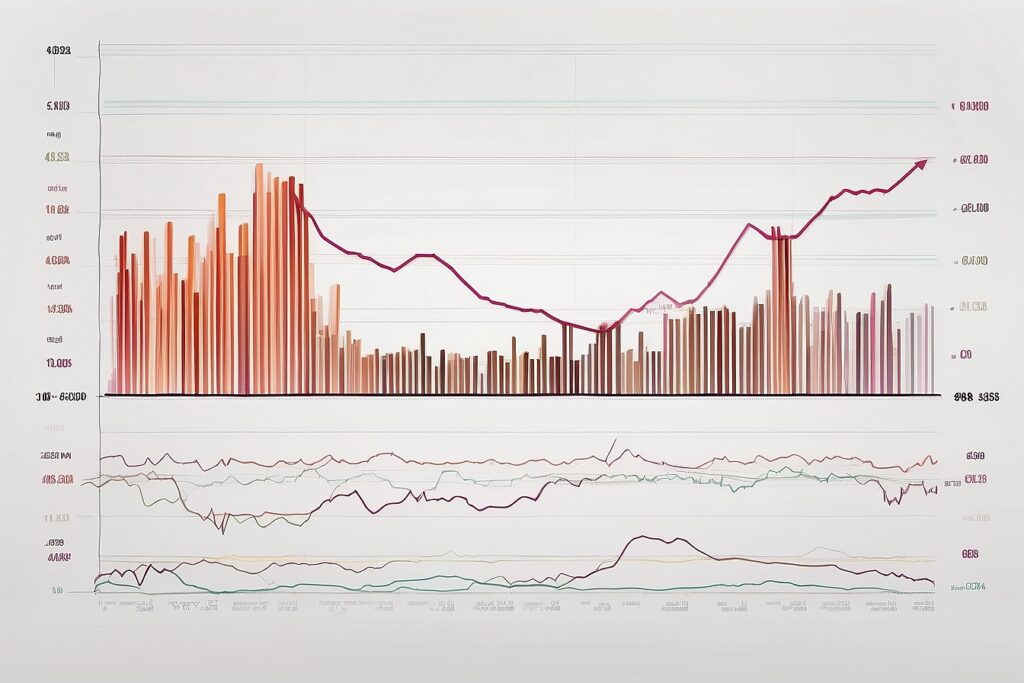

JLL’s analysis reveals a significant amount of liquidity in the commercial real estate sector, with available capital funds, known as dry powder, reaching US$402 billion as of October 2023. This abundance of unallocated funds presents a notable advantage for investors who can swiftly deploy capital and seize opportunities as market conditions evolve positively.

The enduring appeal of commercial real estate as an asset class remains resilient in the face of persistent investment pressures, such as rising inflation and interest rates. According to JLL (NYSE: JLL), investors who recognize the long-term value of real estate have either maintained or increased their target allocations to commercial properties.

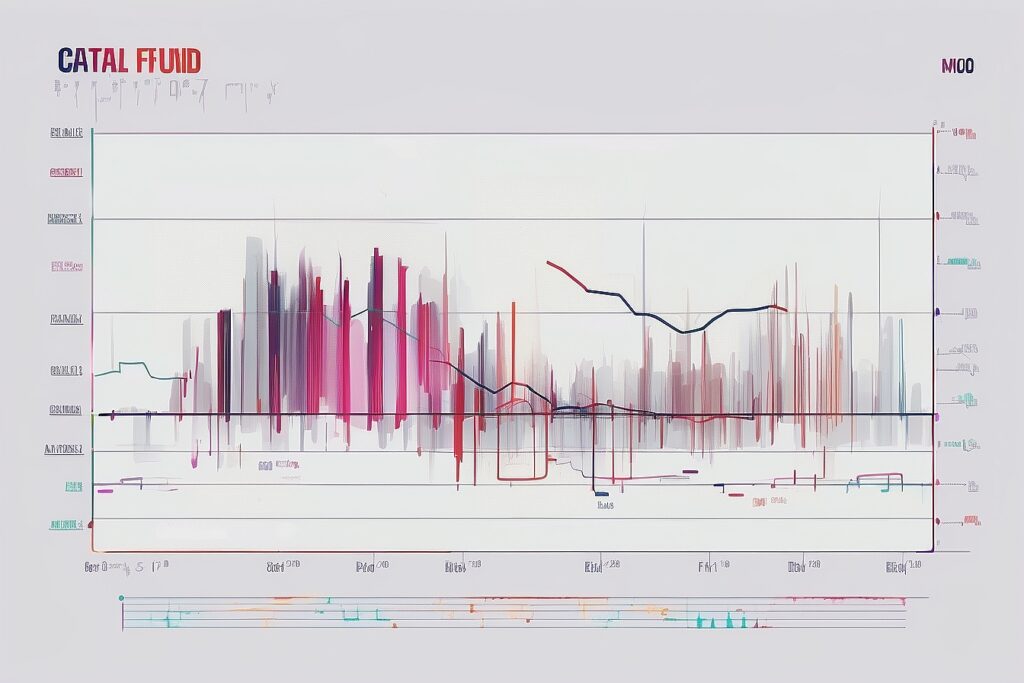

A recent survey conducted by Cornell University indicates a growing trend, with 40% of institutional investors surpassing their real estate allocation targets in 2023, compared to 32% in 2022 and a mere 8.7% in the preceding year.

Notably, in Asia Pacific, entities like Singapore’s Government Investment Corporation (GIC) have bolstered their real estate allocations, rising from 10% in 2022 to 13% in 2023, and further from 8% in 2021.

Similarly, South Korea’s National Pension Service (NPS) plans to increase its target allocation to alternatives, including real estate, private equity, and hedge funds, from 13.8% in 2023 to 15% by 2027.

Pamela Ambler, Head of Investor Intelligence, Asia Pacific at JLL, emphasizes the enduring value of commercial real estate investments despite current market pressures.

She highlights that over the past decade, commercial real estate has consistently proven its worth and maintained its resilience compared to other asset classes. Ambler notes that private real estate investment, in particular, offers lower volatility and is less correlated with other assets, providing investors with a stable income profile and valuable diversification benefits.

JLL anticipates that by the conclusion of 2025, approximately US$3.1 trillion worth of real estate assets worldwide will face maturing debt requiring refinancing.

However, the existing refinancing shortfall—indicating the new equity needed for these loan maturities—ranges from an estimated US$270 to US$570 billion. These impending debt maturities are expected to stimulate transaction activity and prompt a heightened emphasis on diversification strategies across the capital stack.

According to JLL’s research, there is currently significant liquidity available, with dry powder (unallocated capital funds) for commercial real estate amounting to US$402 billion as of October 2023. Given the substantial volume of uncommitted funds, investors who can swiftly deploy capital and seize opportunities as market conditions improve will enjoy a notable first-mover advantage.

Richard Bloxam, CEO of Capital Markets at JLL, comments, “Despite the current impact of higher interest rates on real estate’s short-term appeal, we expect strategic allocation targets to real estate to remain steady and, in some cases, increase, particularly in the long run.

Initially, we anticipate this shift to manifest in sectors like living and logistics, as well as in markets with robust rental growth expectations, where values are also stabilizing.”

The COVID-19 era accelerated existing trends rather than initiating them, particularly regarding portfolio diversification strategies, which had begun evolving in the decade preceding the pandemic.

Globally, collective exposure to the logistics and living asset classes across the largest core funds has surged by US$138 billion since 2016, marking a substantial 263% increase. These sectors now represent approximately 52% of core fund exposure in Asia Pacific, 62% in the US, and 46% in Europe.

The logistics and industrial sector retains its spotlight, with robust demand from both occupiers and investors, coupled with notable innovation and growth projections in manufacturing, e-commerce, and urban logistics on a global scale.

In the Asia Pacific region, logistics now constitutes 38% of core fund exposure, a significant increase from just 11% in 2016. This surge is propelled by the region’s sustained e-commerce expansion amid ongoing urbanization and the presence of densely populated areas.

Conversely, there’s a noticeable downtrend in global fund allocation towards the retail and office sectors. Retail core fund exposure in Asia Pacific dwindled from 21% in 2019 to a mere 7% in 2023, while the office sector witnessed a decrease from 47% to 41% over the same period.