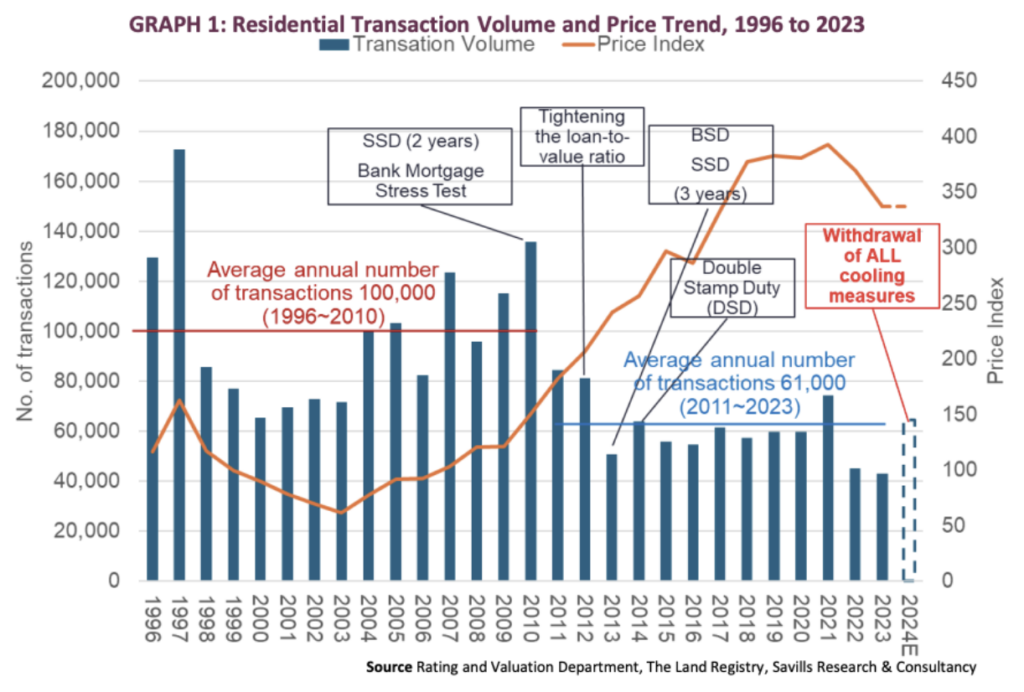

As the Hong Kong property market undergoes significant shifts, developers brace themselves for a surge in residential sales volume projected for the year 2024.

In a recent report by Savills, it was revealed that the Hong Kong government’s decision to withdraw all property market cooling measures, including the cancellation of Buyer’s Stamp Duty (BSD), Non-residential Stamp Duty (NRSD), and Special Stamp Duty (SSD), has sparked optimism among industry players.

The initial response to these policy changes has been overwhelmingly positive. Notably, the launch of the first primary project post-stamp duty withdrawal, Belgravia Place, witnessed a remarkable sales performance. With a 100% sales rate recorded in the first round, equating to 138 units sold within a mere four hours, the market exhibited robust demand. Impressively, approximately 20% of buyers were identified as non-permanent residents, indicating a diverse investor base.

Savills predicts that the withdrawal of cooling measures will stimulate Mainland buyers and talents to expedite their property purchases in the local market. Consequently, residential sales volume is forecasted to rebound significantly, with an anticipated increase of 40% to 50%, reaching an estimated range of 60,000 to 65,000 units in 2024. Developers are expected to capitalize on this improved sentiment by accelerating the launch of their primary projects to meet heightened demand.

However, amidst this optimistic outlook, challenges persist in the mass market segment, characterized by an oversupply issue. With approximately 109,000 units projected to be available over the next four years, absorption of such supply may pose a prolonged challenge. Despite primary transactions hovering around 10,000 units per annum in 2022 and 2023, it may take several years to address this surplus.

In contrast, the super luxury segment witnessed notable activity, exemplified by the recent sale of a prestigious house at 25-26A&B Lugard Road on the Peak. Sold for HK$838 million from a local family to a Mainland High Net Worth Individual (HNWI), this transaction underscores the continued demand for top-tier housing products. While the transaction price represented a discount of approximately 30% from the original asking price, it signifies the enduring appeal of properties offering panoramic sea views, exclusive locations, and ample outdoor spaces.

Despite subdued sentiment in the luxury segment throughout the last quarter of 2023, the cancellation of BSD is anticipated to reignite interest among Mainland HNWIs, particularly those with existing capital in Hong Kong. Consequently, a resurgence in luxury transactions is expected in the coming months, bolstering market activity and potentially stabilizing prices.

In summary, the Hong Kong property market is poised for a dynamic year ahead, characterized by renewed investor confidence, increased transaction volumes, and shifting dynamics across different market segments. As stakeholders navigate these changes, strategic positioning and adaptation to evolving market conditions will be paramount for success in the year 2024.

mexican rx online: mexican online pharmacy – mexican drugstore online

reputable mexican pharmacies online

https://cmqpharma.online/# mexico pharmacies prescription drugs

mexican drugstore online

mexico drug stores pharmacies

http://cmqpharma.com/# purple pharmacy mexico price list

pharmacies in mexico that ship to usa

medication from mexico pharmacy: mexican pharmacy – purple pharmacy mexico price list

indianpharmacy com top online pharmacy india india pharmacy mail order

http://canadapharmast.com/# canadian compounding pharmacy

http://indiapharmast.com/# top 10 pharmacies in india

canadian world pharmacy canadian drugs canadian online pharmacy

pharmacies in mexico that ship to usa: buying prescription drugs in mexico online – mexican pharmaceuticals online

pharmacies in mexico that ship to usa mexican drugstore online medicine in mexico pharmacies

best canadian online pharmacy: best rated canadian pharmacy – canadian drug

mexican drugstore online: medication from mexico pharmacy – buying from online mexican pharmacy

buying prescription drugs in mexico: mexico drug stores pharmacies – mexican drugstore online

buying prescription drugs in mexico mexican online pharmacies prescription drugs mexican pharmacy

reputable canadian pharmacy: reputable canadian online pharmacies – canadian pharmacy ltd

mail order pharmacy india: Online medicine order – Online medicine home delivery

http://foruspharma.com/# medicine in mexico pharmacies

http://canadapharmast.com/# canadian world pharmacy

canadian pharmacy tampa: canadian pharmacies compare – canada cloud pharmacy

mexican pharmacy: buying from online mexican pharmacy – medicine in mexico pharmacies

canadian mail order pharmacy canada pharmacy 24h online canadian pharmacy review

indian pharmacy: best online pharmacy india – world pharmacy india

п»їlegitimate online pharmacies india: buy medicines online in india – cheapest online pharmacy india

mexican pharmaceuticals online: pharmacies in mexico that ship to usa – buying from online mexican pharmacy

best rated canadian pharmacy canada pharmacy reviews safe reliable canadian pharmacy

mexico pharmacies prescription drugs: mexican drugstore online – mexican online pharmacies prescription drugs

https://canadapharmast.online/# canadian pharmacy prices

https://canadapharmast.com/# canadian pharmacy king

canadian pharmacy reviews: 77 canadian pharmacy – canada pharmacy

canada ed drugs: trusted canadian pharmacy – canadian pharmacy king reviews

п»їbest mexican online pharmacies: best online pharmacies in mexico – reputable mexican pharmacies online

canadian pharmacy online ship to usa: canadian pharmacy no scripts – canadian pharmacy 24

http://amoxildelivery.pro/# amoxicillin pills 500 mg

http://ciprodelivery.pro/# buy cipro online canada

cost generic clomid without dr prescription: where can i buy generic clomid pills – where can i get cheap clomid without a prescription

where to get clomid without insurance: where buy cheap clomid no prescription – where to buy cheap clomid online

https://clomiddelivery.pro/# can i purchase generic clomid without prescription

https://doxycyclinedelivery.pro/# doxycycline prescription

http://amoxildelivery.pro/# amoxicillin buy canada

where can i buy amoxicillin over the counter uk: amoxicillin 500 mg tablet price – buy amoxicillin 500mg

buying clomid for sale: cheap clomid now – how to buy cheap clomid no prescription

http://amoxildelivery.pro/# amoxicillin medicine over the counter

https://amoxildelivery.pro/# amoxicillin 50 mg tablets

http://clomiddelivery.pro/# where can i buy clomid without rx

can you buy cheap clomid no prescription: generic clomid without prescription – how to get cheap clomid pills

ciprofloxacin over the counter: buy cipro no rx – cipro 500mg best prices

https://doxycyclinedelivery.pro/# doxycycline cheap uk

http://clomiddelivery.pro/# can i order generic clomid no prescription

http://paxloviddelivery.pro/# Paxlovid over the counter

http://paxloviddelivery.pro/# paxlovid buy

doxycycline 100mg acne: doxycycline hydrochloride 100mg – rx doxycycline

paxlovid for sale: paxlovid pill – paxlovid cost without insurance

http://ciprodelivery.pro/# buy cipro online

http://clomiddelivery.pro/# where to get generic clomid pill

how much is amoxicillin prescription: 875 mg amoxicillin cost – buy amoxicillin 500mg

amoxicillin discount: amoxicillin 500mg – can i buy amoxicillin over the counter in australia

http://paxloviddelivery.pro/# paxlovid covid

http://paxloviddelivery.pro/# paxlovid covid

http://ciprodelivery.pro/# buy ciprofloxacin

https://amoxildelivery.pro/# buy amoxicillin canada

buy cipro: cipro – buy cipro without rx

amoxicillin discount: buy amoxicillin online cheap – amoxicillin no prescription

order generic clomid for sale: order cheap clomid without rx – where to get cheap clomid for sale

doxycycline 200mg price in india: buy online doxycycline without prescription – doxycycline mexico